How the Real Estate Transaction Process is Changing

An agent’s complete 10-step guide to understanding today’s real estate transaction process from start to finish.

Real Estate Transaction Process Flow Chart

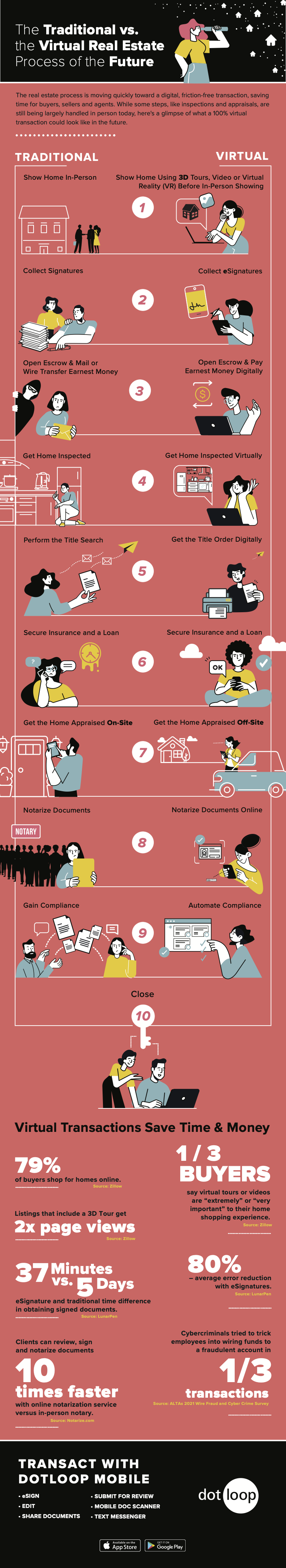

The Traditional vs. Virtual Real Estate Process

As a new or existing real estate agent, admin or transaction coordinator, you probably have many questions. What are the basic steps to the real estate transaction process? Who is involved at each phase in the real estate transaction? What is a virtual real estate transaction process?

That process can look quite differently depending on the transaction process, tools and software used by the real estate office.

For instance, an agent who prefers the traditional process may perform all tasks using manual and in-person methods, from showing the home in person, collecting paper checks for the earnest money and using ink signatures versus electronic signatures (eSignatures).

In contrast, an agent using virtual transaction processes might show the home using 3D tours, use a digital means of transferring the earnest money and share documents with a customer to eSign on a real estate transaction management software platform. Most agents use some hybrid of both.

Here’s the basic real estate transaction process start to finish with a few best practice tips to help you save time, reduce friction and work more efficiently:

10 Steps to a Friction-Free Real Estate Transaction Process

Step 1: List a Home. Make an Offer

Once a seller and their agent have established a sales price, the seller’s agent lists the property on the Multiple Listing Service (MLS) to share with other brokers. The listing agent, or in many cases, the transaction coordinator, prepares the marketing of the home and schedules an open house and showings.

Under the traditional transaction process model, the buyer’s agent may show their customer properties using a combination of digital real estate sites and in-person showings. Since the pandemic shut down in-person showings in 2020, virtual or digital showing tools, like 3D tours, video tours, drone photography and virtual reality (VR), have continued to rise in popularity for their convenience, customer engagement and time savings.

There are advantages to both: In-person showings allow the buyer to smell and hear as well as see the surrounding environment, while a virtual showing experience lets the homebuyer click, “walk around” and tour anytime as they self-navigate the house, saving time and enabling the buyer to move quickly on an offer.

When a buyer finds the home they want, the real estate transaction process officially begins. The buyer typically enters an exclusive agreement to work with an agent who will prepare the purchase offer for the buyer and handle all negotiations.

Step 2: Collect eSignatures

While some real estate agents are still using ink, or “wet” signatures, most have converted to some form of electronic signatures for the ease and speed they offer. Used throughout the transaction with the exception of the close, eSignatures help agents streamline the process of buying and selling a home, while affording their customers a time-saving convenience.

There are many advantages to using eSignatures over wet signatures. One, the signature will be more consistent, page to page, in documents. Also, they save agents and brokerages valuable physical space. Gone are the days of having to store every document in a file cabinet when they can be stored in the digital cloud. Some real estate mobile apps allow agents and transaction coordinators to collect eSignatures on documents through secure texting features.

Real estate customers can trust in the safety of using eSignatures in their real estate transactions. In 2000, the federal government signed the E-SIGN ACT (Electronic Signatures in Global and National Commerce), validating electronic signatures in transactions that affect interstate or foreign commerce. Also, most real estate eSignatures feature a timestamp and other identifying elements to ensure their security.

Step 3: Open Escrow & Pay Earnest Deposit

To keep the funds secure and protected during the transaction process, the listing agent will open an escrow account with a third party, who holds all money and contracts until closing. Some regions use attorneys, while others employ an escrow office to carry out this function. All money pertinent to the transaction flows through the escrow office.

Once the seller accepts a buyer’s offer, the buyer then needs to pay an earnest deposit toward the down payment as a show of good faith that they intend to purchase the property. The earnest deposit is sent to the title company’s escrow officer who holds it in the escrow account until closing.

Buyers need to take great care during this step in the transaction process as paper checks and wire transfers can place real estate customers at great risk of fraud and other acts of cybercrime. The traditional means of sending earnest money through the mail or by wiring funds often result in customers and agents emailing sensitive data like banking accounts and social security numbers, which can lead to identity theft and loss of large sums of money.

As a result, many agents and transaction coordinators are now using a digital earnest money process, which employs bank-level encrypted digital transfers to send the deposit directly to the escrow holder for a safer, faster deposit collection.

How to Pay Earnest Money Electronically

The dotloop Earnnest integration provides your clients with a faster and safer way to submit earnest money. Watch the video below to see how the integration works.

Step 4: Get the Home Inspected

Most homes will undergo an inspection, which involves a deeper look at the home’s condition to ensure the property is in acceptable shape and meets the county or state’s code requirements. A licensed home inspector typically spends hours doing a comprehensive review of the home, visually and manually testing the functionality of the home systems, from heating and air conditioning to electric and structural components.

While lenders may not require a home inspection for conventional financing, FHA or VA loans usually do. In any case, the inspection is highly recommended, though sometimes waived in the case of “as is” sales or a multiple bid situation in which an inspection may be viewed by the seller as a barrier to a buyer’s offer.

Upon completion of the inspection, the inspector will recommend items that may need repair or replacement before the closing. Negotiations often ensue between the seller and buyer as they determine which repairs the seller is willing to make or, alternatively, issue a credit to the buyer at closing. The transaction may fall apart at this juncture in the process if a suitable resolution over a repair issue can’t be found.

Separately, homebuyers will need a pest inspection to guard against any wood-destroying insects, such as termites. Because of the potentially devastating consequences to a wood-framed house, many mortgage companies will require the repair of even minor pest issues before closing.

While most homes are inspected on premises, some companies now offer remote inspections using geo- and time-stamped user-generated videos and remote visual assistance tools.

Step 5: Perform the Title Search

Next or simultaneous to the above steps, the legal title search process takes place when an attorney, title or escrow officer examines public records for any claims to the property to ensure there’s a clear title in which to transfer the home to the new buyer. This process ensures the seller is the legal owner and is eligible to transfer the title. The title company can then issue title insurance as indemnity protection against any title defects and proof of a clear title. This step may take two to four weeks.

To expedite this step, some agents and title companies place a title order digitally through a digital title order service and have it sent directly to their software.

Step 6: Secure Insurance and a Loan

In today’s tight inventory market, buyers need to come prepared and armed with a pre-authorization letter, best known as a “pre-qualification letter” from a lender to show that they’re financially able to borrow the amount of money needed to cover the purchase price. Many sellers and listing agents will only entertain offers from buyers with pre-qualification letters from a lender. Pre-authorization letters demonstrate the buyer has strong financial backing and help inform the buyer of the maximum price they will qualify for in purchasing a property.

Once the buyer’s purchase offer has been approved by the seller, the lender will then work directly with the buyer to furnish the paperwork required to apply and ultimately secure approval for a mortgage.

This is the time when the buyer will also need to secure homeowner’s insurance before the sale can be finalized.

Some transaction management systems host third-party pages to connect customers with broker-preferred ancillary providers, such as insurance and lending agents. This can help cut the shopping time for customers and get them the insurance policy and loan package they need quicker.

Step 7: Get the Home Appraised

In addition to an inspection, a home for sale will need to undergo a real estate appraisal to determine its true value.

The appraisal is required by most lenders before they can approve financing. The appraisal protects their investment by confirming that the loan does not exceed the property’s value.

While most real estate transactions are still using in-person appraisals, the pandemic has accelerated the adoption of virtual processes, including the virtual home appraisal. Rather than visiting a property in person, virtual home appraisers will conduct “curbside” or “drive-by” appraisals to determine the value of a home. They’ll analyze the exterior in person and examine the interior using video. Virtual home appraisals are most useful for single family residentials versus a high-rise condo, where an exterior analysis would not be as useful. Before opting for a virtual home appraisal, make sure to first check with your state’s regulations and lender.

Step 8: Notarize Documents

While most transactions don’t require a notary, some documents, typically on the seller’s side, will require a notary-authorized signature. With the traditional notarization process, agents and transaction coordinators have to schedule a notary for their customers, typically a week prior to the visit. An agent might have to take time out of their day to chase down missing closing documents couriered to a closing. If a seller is traveling or located out of state, the process can become even trickier.

Fortunately, the pandemic has hastened the advent of an easier method with some form of online notarization services legal in most states. By notarizing documents digitally, real estate professionals can save significant time while conveying great convenience to their customers who can review, sign and notarize their documents from their phone or other mobile devices wherever, whenever they want. Documents that may require notarization include commercial lease agreements, survey affidavits, parental guarantor and power of attorney.

Step 9: Perform Compliance

Compliance is critical to the real estate transaction process and can spell the difference between a brokerage landing a million-dollar listing or incurring steep fines in the wake of an unforeseen audit. Compliance represents the set of regulations governing the buying and selling of a property in a particular region and, at a minimum, will dictate which documents are required at closing.

Transaction coordinators need solid workflows and systems to ensure every document meets strict compliance guidelines as determined by the brokerage and regulating bodies.

In the past, agents and admins would shuttle these files around the office via paper folders. Today, electronic, automated workflows cut the paper chase significantly and notify admins at each phase in the process when an action is required, saving time and multiple errors.

For example, an admin may notify the broker via stage notifications to sign documents. Workflow stages can be set according to the different phases of the compliance review process, such as Needs Review, Return to Agent, In Final Review, Approved, Closed and Archived.

Standardized transaction templates also assist real estate teams and brokerages gain compliance by ensuring all necessary documents make it to the proper parties. Transaction templates can be set up by the type of transaction you’re managing, including listings, offers, onboarding new agents and more.

Once the escrow office has verified compliance of all parties, the closing can continue.

Step 10: Close

As noted, the title company or attorney will prepare the closing documents for the buyer and seller in preparation of the transfer of the legal title or deed to the buyer. Once the mortgage company issues a “clear to close,” the funds will be set in motion to transfer to the seller and the title company will record the transaction with the county assessor or recorder’s office with the new owner’s name.

During this phase of the real estate transaction process, the buyer will want to take a final walk-through of the property to make sure that the seller has completed all negotiated repairs; that all negotiated appliances or other items stated in the purchase agreement are intact; and that the home remains in acceptable condition.

Given the many details and deadlines of the real estate transaction process, transaction coordinators can become easily overwhelmed. Consider all the steps involved in one transaction and then multiply that by five or 10 deals at any given time, and it’s easy to see how a transaction coordinator could easily get lost in the details.

For this reason, every transaction coordinator should use some form of a real estate transaction checklist with assignable Tasks Lists. These transaction management tools will help streamline the process from start to finish and keep all parties on task as the deal moves forward.