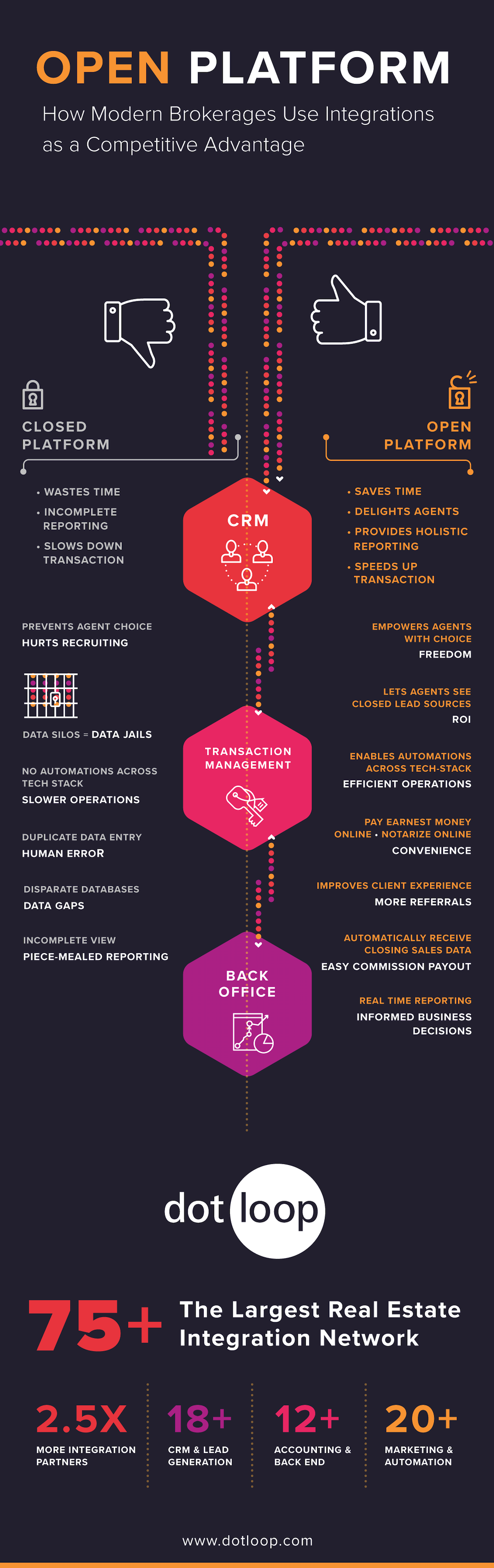

Infographic: How Modern Real Estate Brokerages Use Integrations as a Competitive Advantage

Discover How an Open Platform Can Help Your Tech Stack Software “Talk” for Seamless Connectivity, Reporting and Operational Efficiency

What is an Open Real Estate Platform?

Perhaps you’ve heard the term “open platform” before. Wikipedia defines an open platform as “a software system based on open standards, such as published and fully documented external application programming interfaces (API) that allow using the software to function in other ways than the original programmer intended, without requiring modification of the source code. Using these interfaces, a third party could integrate with the platform to add functionality.”

In plain English, what does an open platform actually mean for real estate brokers, team leaders and agents?

Open platforms enable real estate pros to connect their third-party systems — CRMs, transaction management software, marketing and back-office apps — allowing data to flow, update and automate between systems.

When a real estate transaction management software and its integration partners have open APIs, they can connect and “talk” to each other with permissions-controlled, free flowing data.

Think of your house plumbing, in which the hot water needs to connect to the hot water pipes and the cold water must connect to the cold water pipes. Now, think of your data flow, where every contact, listing address and commission split must seamlessly interface with the correct fields in all of your real estate applications.

Apps with open APIs enable a complete open platform and allow agents and brokers to “turn on the faucet” to all of their data, making sure the correct information flows seamlessly into their separate applications.

“Brokers, teams and agents should have the freedom to build their tech stack, knowing they can easily move their data between platforms.”

In real estate, the transaction management system contains valuable data that helps inform all the other software, including the CRM and back-office accounting software. Therefore, it’s imperative that real estate brokers and agents use a strong transaction management software with centralized data and an open platform to allow the free flow of information between other systems.

Unfortunately, many real estate pros don’t realize the critical role an open platform plays until they’re trapped in a system that severely limits their integration abilities. Or worse, they can’t get their data out when they’re ready to depart the platform. This can create a nightmare for the brokerage required to keep their data on file for seven or more years.

That’s why it’s critical brokers, team leads and agents ask these questions upfront of their transaction management platform:

- Do you have an open platform?

- Do you charge for usage of other tech applications?

- Do you limit usage?

- Do you allow documents to be downloaded?

Perhaps you’ve heard the term “open platform” before. Wikipedia defines an open platform as “a software system based on open standards, such as published and fully documented external application programming interfaces (API) that allow using the software to function in other ways than the original programmer intended, without requiring modification of the source code. Using these interfaces, a third party could integrate with the platform to add functionality.”

In plain English, what does an open platform actually mean for real estate brokers, team leaders and agents?

Open platforms enable real estate pros to connect their third-party systems — CRMs, transaction management platform, marketing and back-office apps — allowing data to flow, update and automate seamlessly between systems.

When a transaction management platform and its integration partners have open APIs, they can connect and “talk” to each other with permissions-controlled, free flowing data.

Think of your bathroom plumbing, in which the hot water needs to connect to the hot water pipes and the cold water must connect to the cold water pipes. Now, think of your data flow, where every contact, listing address and commission split must seamlessly interface with the correct fields in all of your real estate applications.

Apps with open APIs enable a complete open platform and allow agents and brokers to “turn on the faucet” to all of their data, making sure the correct information flows seamlessly into their separate applications.

“Brokers, teams and agents should have the freedom to build their tech stack, knowing they can easily move their data from one platform to another.” – Jason Reinking

In real estate, the transaction management system contains valuable data that helps inform all the other systems, including the CRM and back-office accounting software. Therefore, it’s imperative that real estate brokers and agents use a strong transaction management software with centralized data and an open platform to allow the free flow of information between the transaction management software and its integration partners.

Unfortunately, many real estate pros don’t realize the critical role an open platform plays until they’re trapped in a system that severely limits their integration abilities. Or worse, they can’t get their data out when they’re ready to depart the platform. This can create a nightmare for the brokerage required to keep their data on file for seven or more years.

That’s why it’s critical brokers, team leads and agents ask these questions upfront of their transaction management platform:

- Do you have an open platform?

- Do you charge for usage of other tech applications?

- Do you limit usage?

- Do you allow documents to be downloaded?

Consequences of Transacting Without an Open Platform

According to the real estate management consulting firm T360, real estate brokers use an average of 12+ systems to manage their business. If these systems aren’t talking, chaos can easily ensue.

“We know brokers use a ton of different software to manage their business,” says Jason Reinking, Senior Director, Business Development. “If you’re working with tech partners who don’t have an open platform, it eliminates your ability to pass data back and forth seamlessly and it eliminates your ability to create automated workflows. It can also eliminate your ability to have a holistic view of all your data.”

As noted, some transaction management systems make it difficult for their users to extract their data should they choose to switch platforms. “If you’re a real estate professional and you don’t have your data backed up, there’s a huge risk to your business continuity,” says Reinking.

There are transaction management softwares that even require their users to pay to integrate with their tech stack, while others require downloading seemingly endless documents. In contrast, dotloop offers 75+ integration partners and an open platform that connects them all.

8 Reasons an Open Platform is Critical to Real Estate

1. Creates a Flexible Real Estate Tech Stack

An open platform helps systems communicate with other systems in the real estate pro’s tech stack. Dotloop, for instance, has an open platform enabling users to easily connect their transaction management data with any number of 15 CRMs, 12 marketing and accounting platforms, and 19 marketing and automations applications. This enables functions as basic as not having to re-enter customer or property information to fully tracking lead to close ROI and generating business reporting, by compiling data from CRM, transaction management and back-office systems.

“Brokers, teams and agents should have the freedom to build their tech stack, knowing they can easily move their data from one platform to another,” says Reinking.

An open platform eliminates disparate databases and empowers the real estate pro to build a custom tech stack tailored to their specific needs and proprietary systems.

2. Makes Operations Faster and More Efficient

A tech stack that integrates on an open platform gives the real estate brokerage and team the power to transact faster and more efficiently. CRMs receive data from the transaction management platform, informing of the highest performing lead gen sources in terms of closed business. Accounting systems automatically receive commissions data to calculate splits, and the transaction itself operates more seamlessly when all of these systems are communicating, autofilling and updating data in real time

Take the dotloop integration partner Earnnest for example. Agents using this integration don’t have to wait for the deposit check to clear the bank or experience delays in progressing to the next phase of the closing process. They can simply connect their escrow holder with Earnnest and send the buyers a request to pay their earnest money digitally through the Earnnest app in a matter of seconds.

The Notarize integration offers another significant time-saving opportunity. In less than four minutes, clients can review, sign and notarize their real estate documents 10x faster using this integration.

“In four minutes, you’re not even getting out of your neighborhood, let alone driving to meet the client and waiting for them to show up, make small talk and get the notarization,” says Reinking.

Agents who have their eSigned documents automatically synced with title software ShortTrack save time by submitting their title paperwork digitally, which can shave a reported two weeks off closing time.

Additionally, many CRMs allow you to create loops (transactions) directly from their software. Once the transaction is opened, dotloop sends notifications to a user’s phone (including wearables like your watch) or email, informing of activity on a deal and when action needs to be taken.

“Many of these events are small things that, individually, might not seem like they take that long — to retype someone’s information, for instance — but it may be prone to errors, typos or entail just another step. Add them up and you get pretty substantial time savings,” says Reinking.

3. Make Everyday Transactions More Cost-Effective

In addition to time savings, integrating tech on an open platform makes operations more cost-effective all-around. Consider the hourly wages spent on admin duties in manually setting up workflows versus using automated workflows on a transaction management platform like dotloop where admins can preset workflows for the listing and buying sides.

Regardless of the transaction stage — Needs Review, Approved or Closed — you should be able to push or pull data in the direction you need, whether it’s from your CRM to your transaction management or even creating backup in Google Drive. For example, Sisu can be synced to automate commissions with any level of detail, including calculating pre- and post-split adjustments, dual transactions and referrals. As any broker knows, accounting software is the last place you want typos, so relying on manual entry is not ideal.

4. Improve Reporting

Leveraging holistic solutions for your CRM, transaction management and accounting allows you to generate detailed and accurate reporting. Why? Because you’re centralizing data in the systems that matter the most.

Consider your transaction management system: If you cannot edit, share, eSign documents and submit for compliance in the same platform, then you’re creating data gaps. When you download and upload documents throughout the transaction, you’re limiting the amount of live data that can seamlessly pass to your accounting software. The bulk of your data comes from your documents and when those have to be moved across platforms, it’s like losing pieces of a puzzle. Integrations with front- and back-end apps help inform important business indicators like the effectiveness of a new lead gen source through a CRM or the top performers among agents.

By integrating with Google Sheets or Google Drive, managers can set up a dashboard in Google Data Studio to gain an at-a-glance view of several metrics including:

- Average Days to Close

- High-Performing Zip Codes

- Volume Month to Date

- Agents’ Performance

- Loops in Each Status

“If your CRM and transaction management and backoffice systems don’t have an open platform then you’re never going to get that 10,000-foot view of your business’s health,” says Reinking.

In addition to the above metrics, a well-integrated open platform can help brokers and team leads create a data lake to see where leads are coming from, what advertising performance looks like and which of those resulted in transactions as well as what business is closing in 30, 60 and 90 days and more.

“Otherwise, you’re downloading data from a CRM and downloading data from a transaction management system and trying to merge it all in one report, which involves technical skills and time. All of this becomes much easier to identify with an open platform,” Reinking says.

5. Customize to Your Team’s or Brokerage’s Needs

With an open platform, there’s no longer a need to involve software developers to create a customized system of integrated real estate software apps. As long as the central transaction platform is an open platform, brokers and teams are able to customize the CRM, marketing, backend and accounting applications that work best for their business.

“So if you really want to customize where this is the CRM that’s right for us, and this is the backoffice piece — and how do we get that middle piece to connect them — this is where the open platform comes in,” says Reinking.

Many brokers have proprietary systems that can only integrate with a transaction management system with an open platform. Dotloop, for instance, allows a brokerage to connect not only commonly used, preset CRM and backend applications but also many proprietary systems.

6. Ensure the Security of Your Data Within the Tech Stack

Once a dotloop user authenticates their identity with a name and password, they are asked for access to their data. At any time, a broker or team lead can revoke permissions. When working with an integration within dotloop, users are able to clearly understand and see what data is going to the third-party app and turn that access off independently, without having to involve support personnel.

“You have full control over where your data is going,” says Reinking.

Whether you’re using the Google Suite or DropBox for data backup or a full integration with KVCore or Real Geeks as the CRM and BrokerSumo or Loft47 as the accounting app, a transaction management system with an open platform such as dotloop can tie the stack together in a permissions-controlled environment that helps keep data safer and more secure.

7. Attract Better Talent

Brokers know recruiting is the lifeblood to their long-term success. But for those who dismiss the value a favored transaction management or CRM system holds for a new recruit, they risk losing great talent by not providing the flexibility of an open platform transaction management system.

“You may feel you have the best tech stack, but if you’re recruiting an agent who is used to using a certain CRM — if you force them to drop that and use your tech stack, that’s a much bigger pain of change for that agent. And there’s more training demands on your organization,” says Reinking. “So when you select a partner who embraces the open API, it allows you to recruit agents who can have whatever programs talk to your own brokerage systems. It gives your agents more choice on the platforms they already use without adding more manual data requirements to your systems. It’s about meeting your agents where they’re at.”

8. Transacting on an Open Platform is the Future

If the pandemic taught the real estate industry one thing, it was the critical role digital tech can play in helping agents stay current and agile with a fast-moving market. Today’s agents and admins need to be quick on the draw when transacting deals, while brokers and team leads must optimize their data to make smart business decisions that will drive the future.

As far back as 2015, Forbes started talking about an open API economy. We are now living in the age of the API economy because almost everything we do in our daily lives is open platform driven. Think of Uber Eats or the movie ticket platform Fandango. These are simply open platforms that allow users to view a universe of restaurant menus or to buy tickets from any number of movie theaters. These companies don’t have direct integrations with all of their third-party vendors; rather, they have open APIs that allow them to access all of these entities.

The future of real estate transactions is no different. Those who hop on the open platform will enjoy the freedom of faster, more cost-effective operations and the flexibility, security, improved reporting and customization of a well-integrated tech stack.

“As businesses look to introduce more automation, more efficiency and a better holistic view of their business data and business health,” Reinking says, “none of that will be possible without an open platform.”

With 75+ current integration partners and many more on tap, dotloop continues to lead the industry’s transaction management platforms with the largest, most integrated open platform.

Connect Your Back Office, CRM and 75 Other Platforms

See All integrations »