Is a Housing Downturn Coming?

Experts predict a recession around 2020

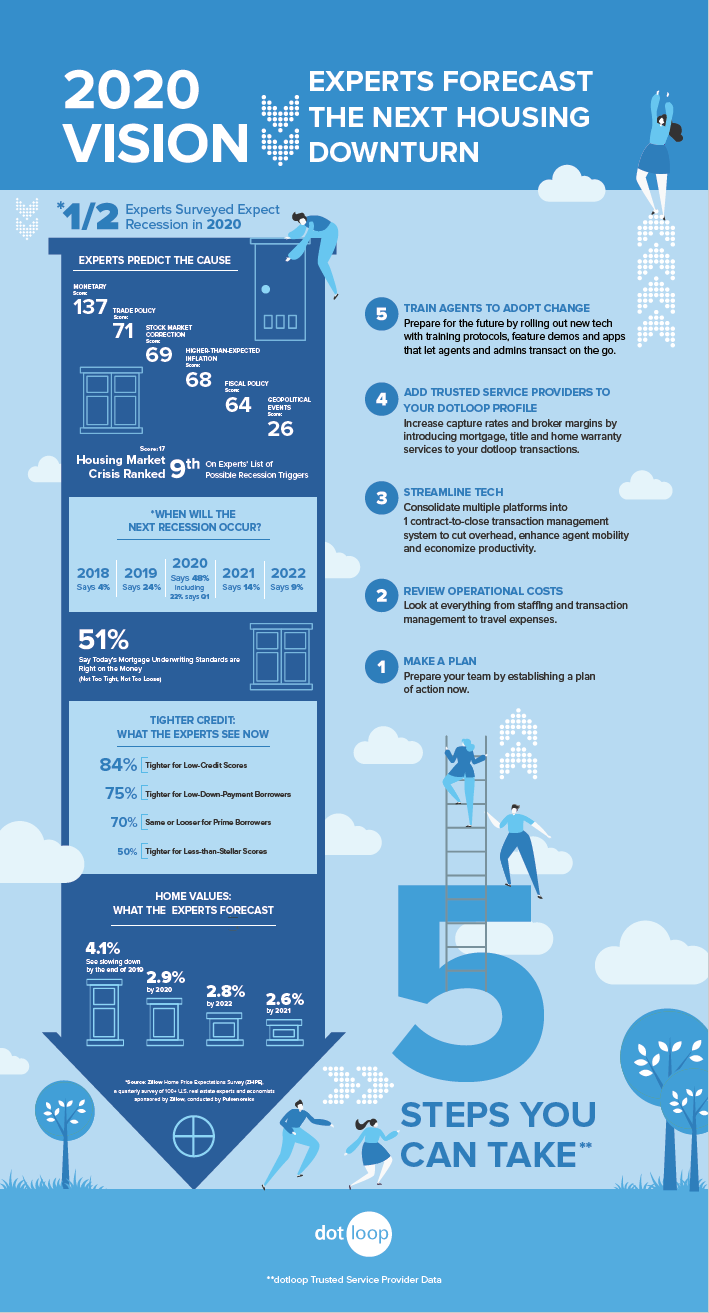

Download this new infographic to learn the facts about what economists are forecasting and the steps you can take to prepare.

Experts are predicting a recession to hit around 2020. With the right preparation, however, you can turn the coming challenges into real estate opportunities.

The current economic expansion officially began in the summer of 2009 and is now the second longest period of uninterrupted growth in American history. For the near term, economists expect it will continue.

Certain known risks that can slow the economy — changes to the federal interest rate policy and trade disputes, for instance — have yet to dramatically shift the market.

However, the national economy tends to run in cycles of boom and bust over the long term, and many financial experts are predicting some sort of correction over the next two years.

Real estate brokers who prepare for this change ahead of time will be better positioned to not just survive but actually gain market share.

How a Recession Will Affect Housing

Some define a recession as a period of at least two consecutive quarters in which the economy is in decline, but, as the National Bureau of Economic Activity notes, many factors can come into play, including Gross Domestic Product (GDP), Gross Domestic Income (GDI) and the depth of economic activity decline. Therefore, recessions don’t always involve two consecutive quarters of decline. As economic activity slows, both businesses and consumers cut back, causing the contraction to spiral.

When there are large-scale job losses, some homeowners may choose to sell their homes or lose their homes to foreclosure when they fail to keep up with monthly payments. When these losses are concentrated in certain communities, it can cause an imbalance between supply and demand, leading to falling prices and home values. When home prices drop below what people owe on their properties, foreclosures, short sales and REOs further depress the market.

Compounding the issue, people choose to stay in the same home for longer periods of time, thus negatively affecting both housing supply and demand. All of these factors converge to cause fewer closings and a drop in business for brokerages and their agents.

“The 2008 recession was preceded by what was initially thought to be a typical, regional housing slowdown in the Southwest. Early on, few people anticipated the deep linkages between that sector and the national financial system.”

– Zillow Senior Economist Aaron Terrazas

What Economists Predict

Financial experts have differing opinions on what could trigger the next recession. While the housing bubble drove the last recession, lending has remained fairly conservative over this economic recovery and other factors may be more likely to trigger the next downturn.

Nevertheless, the experts are in basic agreement that they expect it will begin sometime around the turn of the next decade (2020) and that it will have the following effects. See infographic for Zillow’s survey and predictions of 100+ real estate experts and economists.

In the face of financial uncertainty, businesses and consumers will curtail their spending, which will lead to higher unemployment, further hampering economic activity.

The Federal Reserve would likely respond by lowering interest rates, while Congress and the Executive Branch could respond through fiscal stimulus spending. However, with rates not far above historic lows despite recent increases and public expenditures already at record highs, there may be less room for economic intervention.

As businesses and households fail to meet their financial obligations, lenders will be forced to absorb the losses, which will cause them to raise their criteria for making loans and tighten credit.

Recessions have had varying effects on the housing market. The economic downturn of 2001 caused little disruption in home sales nationally, though they had a significant effect in some of the most exposed regional markets. On the other hand, the recession of 2008 touched nearly all regions across the nation. Housing prices plummeted and the number of transactions dropped by half of what they had been before the downturn.

It’s likely that another recession will have some effect on housing. In areas with substantial job losses, home values could drop. For agents in those areas, this will likely lead to a significant decrease in income and many will leave real estate to pursue other work.

Faced with uncertainty, brokers who want to survive and even grow during the coming downturn must plan now. Those who wait until their local market has turned will find themselves reacting in the midst of a crisis with little time to begin making needed operational changes.

Here are several courses of action to consider in preparing for a downturn.

As a result of the 2008 recession, membership in the National Association of Realtors (NAR) decreased by approximately 255,000, from more than 1.3 million to 999,824. And according to the National Census Bureau, the number of brokers shrunk by about 21% with revenues dropping nearly 23%.

Time to Take Action

Stick with what’s working now. Nobody can say for sure when the next recession is supposed to happen — in fact, it may not happen at all. Former Federal Reserve Chairwoman Janet Yellen once said that market expansions don’t die of old age.

NAR Chief Economist Lawrence Yun dismisses concerns about a significant slowdown and whether the housing market has peaked. Rather, he believes the slowdown will affect the country’s most overheated real estate markets in 2018 due to insufficient supply and rapidly rising home prices versus weak buyer demand, which has historically been a more reliable indicator of a slowdown trend.

Many brokers will continue with business-as-usual until they see significant signs that a downturn has actually begun. Many real estate agencies survived the lean years of 2011 and 2012 by cutting back their operations to a survival level.

Of course, if another collapse of the housing market does occur, a brokerage may not stay in business long enough to come up with a plan to make the necessary changes.

Flex toward the future now. In the last downturn, brokerages that were able to pivot quickly to meet clients’ evolving needs survived, and in many cases, gained market share.

Agile brokers will not only use the best technology and proven workflows to gain efficiency in today’s housing market, but they’ll use the same strategic thinking when planning for multiple contingencies. As a result, their partners, agents and staff will know what to do when conditions begin to change.

During the last housing downturn, many firms survived by slashing their operating expenses, beginning with their marketing budgets. However, brokerages that anticipated a changing market had already built financial reserves earmarked for marketing. As unprepared brokerages withdrew their media presence, the forward-thinking brokerages stepped into the vacuum and actually grew their market share. Similarly, residential rental firms set aside cash to buy houses at deep discounts at the bottom of the market.

Agents should also start talking to their clients and spheres of influence now, proactively reminding them that they’re here to help them plan for any future real estate needs. Arming clients with data to understand today’s market conditions and local trends will help both agent and client plan accordingly while positioning the agent as an educated, real estate advisor and expert.

Of course, in a contracting real estate market, the client’s needs will change too. Those listing their houses will need agents with creativity and tenacity to help them sell in a market heavily tilted toward buyers. Financial institutions will need agents with expertise in foreclosed properties. And buyers considering REOs will need an experienced professional to help them find the best value and guide them through this kind of purchase process.

Finally, sellers will require creative solutions for homes that simply aren’t selling, including the option of renting out until the market is more favorable. The brokerage that’s prepared to offer these recession-specific services can turn a tough market into new solutions.

“Real estate professionals are in the best position to know how healthy their local economy is. Having spent years immersing themselves in their targeted area, they may be the first to sense when things are changing.”

– Zillow Senior Economist Aaron Terrazas

How to Prepare for a Downturn

1. Form a Plan

Mapping out a plan of action ahead of time gives leadership, staff and agents a chance to discuss strengths, weaknesses and alternatives well before having to take action.

Kevin Hooper, an eXp Realtor who survived the last market crash, says, “I don’t think it’s a question of if the market drops — it’s a question of when and how far.”

He advises agents and brokers to prepare to “go wide” before crunch time occurs. “That does not mean you change your business structure or business plan right now,” he says. “It means you have thought about the process to widen your reach when and if you need to.”

2. Get Operationally Efficient

Marnie Blanco, dotloop Vice President of Industry Relations, notes that the leading brokerages are already preparing for a change by getting their houses in order. “They’re reviewing operational costs on everything from their physical offices to support and technology. And it’s not just high overhead they’re concerned about. They’re figuring out ways to consolidate technology so they not only save money but they end up with an efficient and robust system,” she says.

Blanco adds that much of the customization dotloop is performing for larger brokerages now aligns with this philosophy.

Many brokerages, she says, are already training agents to be ready for a downturn. “Last time, the change in market conditions hit agents like a brick wall. As regular listings dropped, foreclosures, REO and short sales skyrocketed,” Blanco says. That’s why forward-thinking brokers are training their agents to prepare for these types of listings as well as how to work with investors.

Even if the economy doesn’t take a hard turn, these strategies can enable growth in all economies. Being prepared with the tools and resources that help in a down economy will only lift agents and brokers higher in a strong housing market.

3. Prepare People for Change

An oft-cited study by the Harvard Business Review revealed that nearly 70% of all change initiatives in business fail. In most cases, this inability to adopt a new way of doing things isn’t due to a lack of resources spent by the companies. It’s because people find it difficult to change.

People don’t change because they’re given information. They change when they’re able to take ownership of the plan of action. See infographic for helpful tips on helping agents adopt new tech and other changes.

4. Implement Innovation Now

New technology that’s designed to bring efficiency and agility should be in place well ahead of time, with staff and agents already trained and using advanced features. This will not only ensure that it’s fully functional when the market demands, but the new tech will benefit the brokerage under any market condition. For example, a brokerage upgrading to dotloop’s all-in-one transaction management platform will immediately gain efficiency from the customized workflows, agent and admin collaboration, and integrations with CRM and back office tools.

While investing experts, economists and financial pundits are all on the lookout for signs of the next downturn, Zillow”s Terrazas says that it’s real estate agents who might have the best insight into when that will happen.